Picture this: a world where your lightbulb, refrigerator, and even your car are connected to the internet, streaming information and responding to commands from the comfort of your smartphone. It sounds like a futuristic vision, right? It's our reality today, thanks to the Internet of Things (IoT), a phrase coined by Kevin Ashton in 1999 that has since grown into a technological revolution.

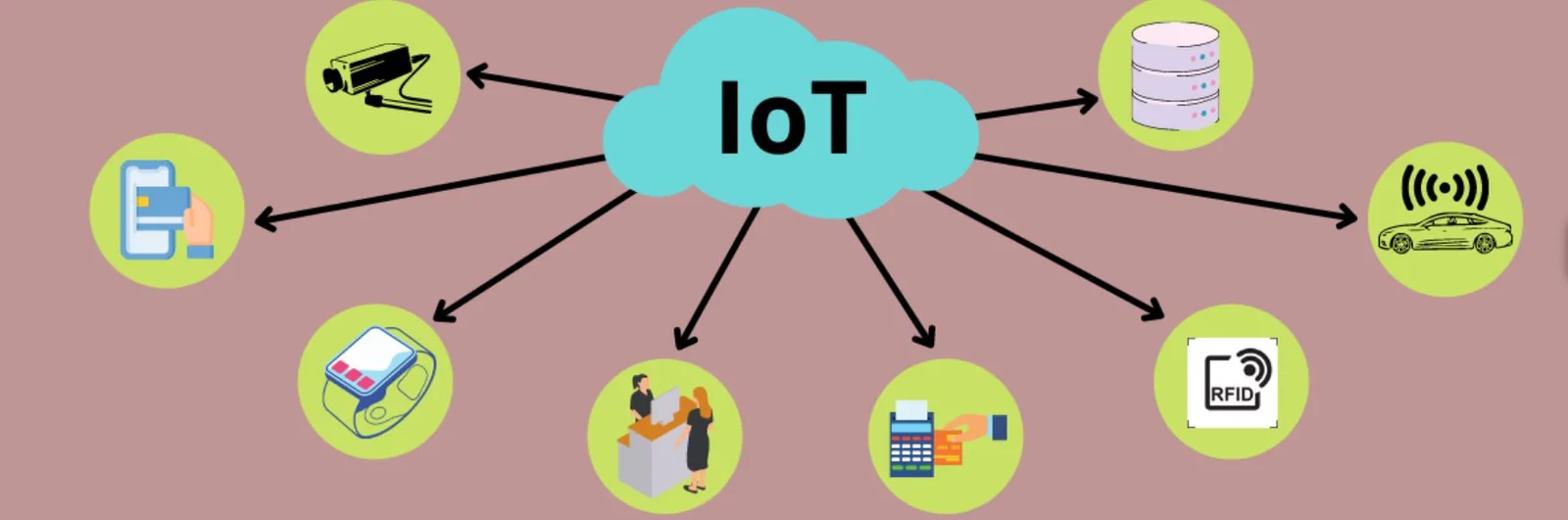

The IoT is all about connectivity. It's a network of physical billions of objects - 'things,' if you will - embedded with sensors, software, and the power to exchange data with each other and the world via the internet. These things can range from everyday household items, like lightbulbs you can switch on with an app, to complex systems like autonomous farming equipment and smart factory machinery. It's about turning dumb objects into intelligent devices that can communicate and collaborate to make our lives easier.

So, what's the actual value of IoT? Nowhere is this potential more pronounced than in the health, banking, and finance sector. Although IoT's application in these sectors is still emerging, around 40% of financial institutions are already exploring the possibilities of IoT and big data. The ability to collect a wealth of data, from customer spending habits to asset usage, opens up opportunities for personalized services and efficient operations.

IoT integration in ATMs presents an innovative approach to fraud detection. By monitoring customer behavior, including withdrawal patterns, and gathering data, ATMs can alert banks to suspicious activities. For instance, abnormally large withdrawals or usage of ATMs at odd hours could trigger an alert for potential fraud.

Another practical example of IoT in fraud detection is wearable devices such as smartwatches and fitness trackers. When equipped to monitor user location and behavior, these devices provide a continuous stream of data that, when analyzed, can indicate abnormal activities. Suppose a credit card transaction is made in a location vastly different from the tracked location of the user's wearable device. In that case, it could be flagged as a potentially fraudulent transaction, prompting an immediate investigation.

Or picture an insurance company adjusting premiums based on a driver's actual driving behavior, tracked via IoT devices, rather than traditional indicators like age or gender. Today's vehicles, equipped with IoT technology, are veritable data-generating machines. This real-time information is particularly valuable for insurance companies aiming to identify fraudulent claims. IoT technology can monitor driving patterns, locations, and behaviors to detect discrepancies between actual data and the incidents reported by policyholders, helping curb insurance fraud.

Another compelling application of IoT lies in Point of Sale (PoS) systems. These IoT-enabled devices can identify purchasing patterns and behaviors. A drastic deviation from a customer's usual purchasing behavior may be flagged as potential fraud, warranting further investigation.

The health industry uses sensors to monitor patients' conditions in real time and outside the hospital. In other words, IoT helps the healthcare sector improve the care of needy ones even at the time of risk.

Furthermore, hospitals can use smart beds equipped with sensors to collect data on vital signs, oximeters, body temperature, blood pressure, and more. IoT is also helpful in managing city traffic using the concept of smart cities. IoT devices, such as sensors and connected cameras, can be integrated into traffic systems to monitor congestion, vehicle speed, and other key metrics in real time. This data can then be analyzed and used to control traffic lights, adjust signal timing, or redirect traffic flow to less congested routes, helping to improve traffic conditions.

As IoT continues to revolutionize various sectors, it is critical to bear in mind the cybersecurity implications. While these devices have immense potential in identifying and preventing fraud, cybercriminals can also target them. Therefore, robust and updated cybersecurity measures are as essential as IoT devices.

Challenges of IoT in Banking and Fintech

No set/common standards for maintenance

There is no standard for the compatibility, management, and maintenance of IoT devices. This creates difficulty for users using devices and systems from different product manufacturers to connect and communicate with one another. Banks and fintechs deal with massive data stored on multiple IoT devices, which becomes challenging to manage again.

Hacking

In IoT, especially consumer IT, user data about their daily routine is gathered to help them provide improved services. However, this data travels through various nodes present in a network, such as devices, services, and solutions. So, the data-storing device becomes vulnerable to risks and policy violations.

Cyber attacks such as distributed denial of service (DDoS), Denial of Service (DoS), data theft, etc., are common in IoT systems. And such risks are highly hazardous for banks and fintech organizations where crucial information is stored on their devices, such as customers' personal information, credit and debit card data, funds, etc. If this critical information is hacked or leaked, it can translate into fraud, money theft, and whatnot.

In essence, the Internet of Things and AI are more than just things. It's a transformative force poised to change how we live, work, and interact with our world. It promises operational improvements and a more profound, personalized understanding of its customers for the banking and finance sector, unlocking opportunities for growth, innovation, and superior service delivery. So, as we stand on the brink of this exciting frontier, one thing is clear: the future is not just connected. The future is smart.

.jpeg)