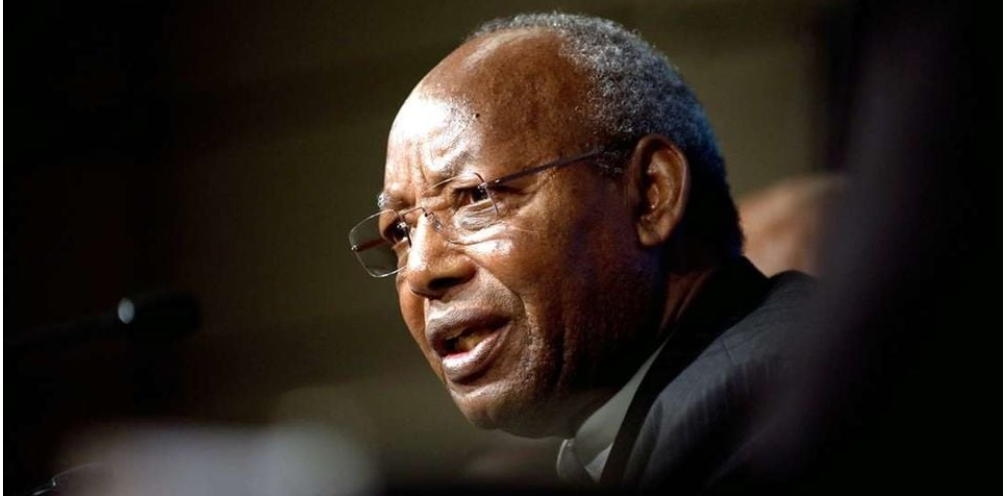

In Africa, governments are more likely to fight or stifle newer technologies than embrace them, spurring growth. But in the 2000s, Kibaki's regime embraced new ideas that laid the ground for Kenya to be the fintech powerhouse in Africa. And when you look back to the Kibaki era, one minister stands out: John Michuki.

Globally, the fintech sector has grown in leaps and bounds, from the early days of mere electronic transfer of money to individual accounts and across borders to newer, broader technologies such as blockchain and digital payments solutions, among other breakthrough ideas that have transformed the finance and technology landscape. In Africa, Kenya, alongside Nigeria, leads in adopting these new fintech ideas that are changing every sector, from banking to lending, to insurance, to agriculture, to healthcare. Virtually every industry is embracing Fintech. The fintech technology that changed Kenya, putting the country on the global map, is the invention of MPESA.

Launched in 2007, M-pesa has become the most successful mobile money platform, addressing the need for financial inclusion. The idea of developing a mobile money product dates back to 2003 as a promising approach to sustainable development. The proposal was by Nick Hughes, then the head of social enterprise at Vodafone. His proposal to use mobile phones to deliver financial services was awarded one million pounds by the Department for International Development (DFID), a United Kingdom government department.

Hughes leveraged partnerships and in 2005, after having brought on board Susie Lonie, who had a background in mobile commerce, M-PESA was ready for a pilot. Safaricom, M-PESA's parent company went on a recruiting spree, identifying airtime dealers. In October 2005, eight agent stores, and later 15, were given phones with an M-PESA menu. On 6th March 2007, M-PESA was officially launched. A month later, it had 19,671 mobile active users.

MPESA's success was attributed to the trust of users and stakeholders in the platform. This trust was cultivated by regulatory frameworks established by the late John Michuki, who served briefly as an acting Minister of Finance in 2008 after the ouster of Amos Kimunya. By and large, Michuki was a performer, and many Kenyans remember the sanity he brought to the Matatu industry, as the Minister of Transportation, and his quest to clean the Nairobi River as the Minister of Environment. (if you rattle a snake....) Michuki championed law, order, and accountability, which are crucial to any emerging industry, particularly Fintech.

John Michuki's Regulatory Legacy

John Michuki is best remembered for his transformative "Michuki rules," which brought order to Kenya's chaotic public transport sector. These policies introduced mandatory safety standards and accountability measures, fundamentally changing how the industry operated. While Michuki's primary focus was on transport and environmental reforms, his broader regulatory philosophy laid the groundwork for other sectors, including fintech.

His approach to regulation was marked by strict enforcement and a commitment to accountability. In the public transport sector, this meant ensuring that operators adhered to safety regulations, which, in turn, increased public confidence in using matatus (public minibuses). Similarly, in the environmental sector, Michuki's efforts to rehabilitate the Nairobi River and enforce pollution laws demonstrated the power of structured, data-driven policies to deliver tangible results.

Crucially, Michuki played a direct role in allowing M-Pesa to be rolled out, even when Kenya lacked specific regulations for mobile money services. In 2008, when banks lobbied against M-Pesa, concerned it would lead to disintermediation and drive down the use of savings accounts, Michuki, as the acting Minister of Finance, ordered an audit of the mobile money transfer system. This audit was crucial in legitimizing M-Pesa's operations.

Sometime in late 2008, as M-PESA was running into trouble just as it was learning to walk, Michael Joseph, then CEO of Safaricom, set up an appointment with Michuki to defend the reputation of his then two-year-old "foster child". In that thickly carpeted, nearly sound-proofed room that was Michuki's office, Joseph used his phone to demonstrate that M-PESA could be used to pay Michuki's foreman's wages at his rural home outside Nairobi. Once the foreman confirmed he had received his wages, Michuki remained impressed by how convenient, fast, and easy it was to use M-PESA. And the minister was not an easy man to impress.

In January 2009, following the audit, the Treasury under Michuki's leadership issued a statement reaffirming that mobile money was not a banking service, but a low-value retail money transfer service. This distinction was vital for M-Pesa's continued operation and growth. The grumblings by the banks, who had been around for more than a century, soon died out and M-PESA was left to chart its own path.

The Impact of Regulation on Fintech Growth

Michuki's regulatory philosophy helped shape a legal and economic landscape where fintech could thrive. By emphasizing order, transparency, and accountability, he laid the foundation for regulatory frameworks that reduced risks and attracted both local and international investments in digital financial services.

The regulatory groundwork that Michuki helped establish extended beyond mobile money to include digital lending, blockchain solutions, and insurance technology. His influence can be seen in the evolution of Kenya's financial sector, where regulations have continually adapted to keep pace with technological advancements.

Because he was a man of his word, his work in various ministries helped people think about the government differently. His work in the environment promoted sustainability and trust, where people now believed that government rhetoric could be turned into action. The success of these initiatives fostered public trust and demonstrated that reinforced law and data could produce tangible results.

The evidence of his actions and the stability of his policies facilitated the growth of the fintech industry, which depends on a predictable and safe regulatory framework that helps reduce uncertainties that often plague emerging industries. It is the reason Fintech has flourished in Kenya. This foundational element led to innovations such as MPESA and other platforms that now define the day-to-day lives of Kenyans.

Today, Kenya's Fintech ecosystem transcends mobile banking, digital lending, blockchain solutions, and more. All can trace their success to Michuki's progressive ideas and establishing a government that embraces technology and comes up with regulation that spurs, not stifle, the growth and adoption of new technologies.

This has spread to the neighboring countries. East Africa's young, tech-savvy population and the increasing mobile penetration attributed to the decrease in the price of smartphones, which played a major role in increasing adoption and provided a fertile ground for further development, and with the aid of supportive policies and increased investment, Fintech will steward the region's financial sector and drive economic growth.

Value propositions the fintech industry presents include lending, payments, insurance, and investments. The East African lending sector is largely immature except in Kenya. The East African banking sector has, however, maintained reasonable profitability. Kenya is the most mature market with relatively good growth in credit and profitability and with the increasing emergence of Fintech in East Africa encompassing countries such as Kenya, Uganda, Tanzania, and Ethiopia, this sector shows immense potential for growth in digital and technological advancements traversing even into Africa whose tech support ecosystem is concentrated in Nairobi, Kenya hence being referred to as the "African Silicon Valley" positioning Kenya as a leader in Fintech through the success of M-pesa which has set the standards for mobile financial services in the region.

John Michuki's commitment to law, order, and structured governance played a foundational role in creating a stable environment that has allowed Kenya's fintech sector to flourish. His influence remains a vital element of this success story. Michuki's regulatory legacy teaches us that while innovation is essential for growth, it must be complemented by robust governance structures that foster stability and public trust.

.jpeg)